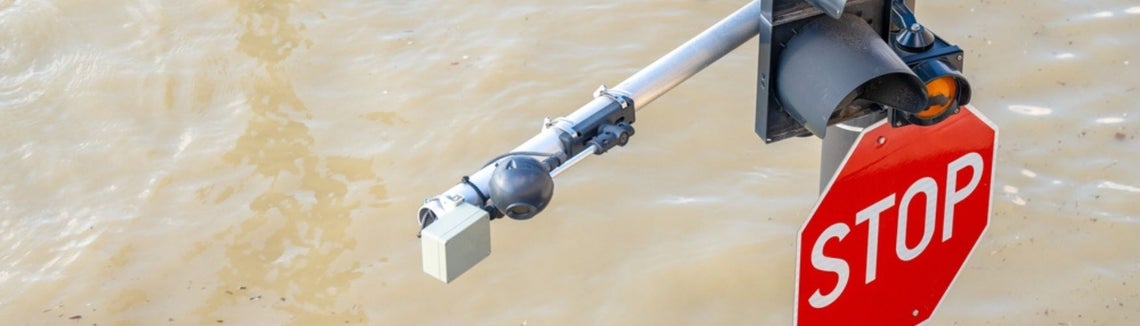

Storm Boris, which struck Central and Eastern Europe in September 2024, brought unprecedented flooding and devastation across multiple countries. The storm's impact on the insurance industry has been significant, with insured losses estimated between €3 billion and €5 billion.

Czech Republic

he Czech Republic experienced torrential rainfall, with some areas receiving up to 20 inches of rain. The flooding caused widespread damage, including power outages affecting 250,000 households and extensive evacuations. One of the major business impacts was the flooding of the BorsodChem chemical plant in Ostrava, which had to shut down operations. The national insurance association estimated total insured losses at 17 billion Czech koruna (approximately $750 million ).

Poland

Poland was one of the most affected countries, with over 18,000 properties damaged and significant infrastructure destruction. The insured losses in Poland are estimated to be between €2 billion and €3 billion. The flooding led to the evacuation of thousands of residents and severe damage to agricultural, commercial, and public-use buildings. One of the most significant business impacts was the collapse of the main bridge in Glucholazy, which disrupted transportation and commerce. The insurance industry faced a high volume of claims, particularly from commercial risks, highlighting the need for better flood insurance coverage for homes and automobiles.

Hungary

Hungary saw extensive flooding, particularly in Budapest, where the Danube River reached critical levels. The total insured losses in Hungary were lower compared to other countries, but the impact on local communities and infrastructure was significant. One of the major business impacts was the closure of the Danube bridge, which disrupted transportation and commerce. The total insured losses in Hungary were estimated to be around €150 million. The insurance industry faced claims from both residential and commercial sectors, emphasizing the need for comprehensive flood coverage.

Romania

Romania, the counties of Galati and Vaslui were severely impacted, with more than 5,000 homes damaged and hundreds of people needing temporary shelters. One of the major business impacts was the flooding of the ArcelorMittal steel plant in Galati, which led to a temporary halt in production. The total insured losses in Romania were estimated to be around €200 million. The insurance industry faced claims primarily from residential properties, underscoring the need for improved disaster response and infrastructure resilience.

Slovakia

Slovakia experienced major disruption due to flooding, with states of emergency declared in several areas. The insured losses in Slovakia were substantial, with significant damage to residential and commercial properties. One of the most significant business impacts was the flooding of the Slovnaft refinery in Bratislava, which caused a temporary shutdown and financial losses. The total insured losses in Slovakia were estimated to be around €300 million. The insurance industry faced a surge in claims, highlighting the importance of effective flood management and disaster preparedness.

Storm Boris has had a profound impact on the insurance industry across Central and Eastern Europe. The event has underscored the importance of comprehensive flood coverage, effective disaster management, and infrastructure resilience. To mitigate the impact of future natural disasters, it is essential for businesses and policymakers to focus on prevention and invest in the resilience of new buildings and infrastructure. By incorporating robust flood defenses and disaster-resistant design principles, we can better protect communities, reduce insurance claims, and ensure a more resilient future.

Beinsure.com,Jbarisk.com

JBA Risk Management : Reinsurance Network : Romania Insider : Moody's RMS : Wikipedia : Commercial Risk Online